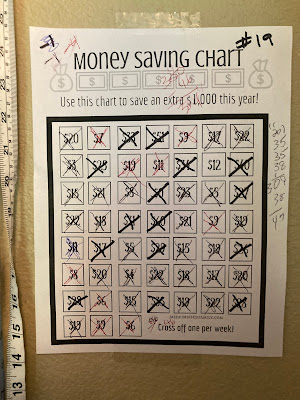

On to chart #20. This is what happens when you spend hardly any money on groceries, and you hang your laundry, and use your ceiling fans, and open your windows at night after turning off the AC. This is what happens when you downsize from a house that was 3500 sf, to 1600 sf. This is what happens when you conserve water and lower your footprint. It all adds to savings. Plus having a bang up wedding season helps. Also staying home and not driving places helps.

Yesterday I ripped three dresses for alteration, two flower girl and one mother of the bride. I will finish a bride dress today and get these three dresses done and call it a day.

I have clothes on the line and another load to hang. I picked enough green beans for a meal and have one cucumber ready. It is a frustrating garden season here, but it does look like some of our squash plants are looking healthier.

Tomorrow we are going with Signe' and family to Colfax days. It should be fun. Lots of food and booths and fun. I just want to get out of dodge. I really stay home most days and getting out is a dream.

I have a $1000 squirreled away for my next bill to pay. SO that makes me happy. I will keep at this until I finish and then try for $6000 in my emergency fund. Which is three months of minimum expenses for us.

Paying myself first was a hard concept for me to learn when it came to saving money. I was always for spend everything I earned and what I lacked in earnings use credit to pay for the rest. The concept of paying myself first never came into focus although I had heard it many times.

It wasn't until I got sick and we went through our $1300.00 savings account for one Arthritis treatment that hubs and I decided something had to be done. Even though we were deeply in debt, we immediately started to have 10% removed from his paychecks and put into and investment account. Then for the next 15 years we took every raise he was given and put it into savings. We lived poorly on the rest.

When I started using charts to track my savings it helped me to see where the money could go. It allowed me to pay off debt and apply the money specifically to a plan. This has made all the difference. Kinda of like the "Tree in the yellow wood."

Then I started money saving challenges. Like saving all my change which really made Christmas easier. We went into less debt at Christmas time. Then it was adding the penny challenge which again helped with Christmas expenses. Then the $5 dollar bill challenge really paid off! I paid off the house a few years ago with $5 dollar bills. I have saved for vacations.

This challenge can be hard sometimes. As I have a set amount of money for things and all my change comes back in 5's. This can really put a damper on things. But I persevered and boy did it pay off.

Lastly it has been the 36 dollar a week challenge. This money goes for a direct purpose. I know what I am saving for. It isn't like I am just saving for and unknown something. With a specific goal in mind, it is easier to stick to the plan. Like knowing I get to go on a girl's trip with Sissie, Sluggy, and Anne. Every time I am tempted to dip into these funds, I remember what I am saving for, and I get excited.

These challenges come first before any more money is spent. Sometimes I run out of cash on hand, and I have to borrow, and I usually do this from the penny can savings, but I always put it back.

Having every penny accounted for helps you realize where your money is going. I still buy things; I still have fun money. Last weekend I bought 2 potholders for $2 a piece from an elderly lady. I also bought a small beautifully made cutting board for cheese and meat from a gentleman. I don't do without, but I do think about how I spend.

I would encourage everyone to have some kind of a savings challenge. When you get paid pay that challenge first. No matter how small the habit is developed, and it will reap great rewards.

Do any of you pay yourself first? If so how?

Have a great and productive day staying positive while you are in the negative.

Kim

.jpg)

I pay myself first by having my 401k deducted (full IRS max) before I get paid. Then, I save extra in an HSA, plus I do after tax 401k (back door) savings. Then, I get what's left. I also try to save vs spend my stock (I get a bonus, salary & stock), although that one ebbs & flows a bit, depending on expenses.

ReplyDeleteWhen I was paying off the mortgage, I transferred every extra dollar (rebates, eBay, FB marketplace, bonuses, gifts, etc) to the monthly mortgage payment. It was so motivating to see it dropping.

Good work making all of the changes, big & small, to keep yourself on track!

You are very blessed at your age to be able to do what you do and save so much. But you work at it and are and inspiration.

DeleteYou are amazing Kim! Good job! You will have your mortgage paid off before you know it! Cindy in the South

ReplyDeleteI feel like it is so slow. I just want instant results and I know that can't happen.

DeleteWoo Hoo on chart number 20! You are doing a fantastic job Kim!

ReplyDeleteThey are really going by fast this year.

DeleteLessons hard learned that we all can benefit from. I can't do all, use so little cash, and investment accounts are scary right now, but I have faith they'll rebound. Funding a great deal on something needed or wanted and saving the difference is another strategy. I agree with Cindy. You'll get that mortgage paid off sooner than you imagined.

ReplyDeleteIt seems really slow right now, but I need to pay for other things, and I will start hitting it harder.

DeleteI do pay myself first! PIus, I still have coins I saved from the last two years, each in their own container, trying to figure out what to do with them. I am saving my rewards from Amazon for a big purchase I don't want to come out of my pocket.

ReplyDeleteThat is a great idea. I love saving my coins

DeleteOnce our mortgage was paid off (that's what I saved for in the beginning) it was so much easier to save for other things. I am now quite happy with what we have and still manage to save a bit most months even being on pension.

ReplyDeleteGod bless.

I'm so proud of you! Great job on those savings. I hope you have a wonderful time in Colfax today. I had forgotten that the big celebration was this weekend. My Jeff is at work today so it is a day at home for me, which is just fine with me after having Steven here yesterday. ;) Tomorrow my two oldest grandsons, Bradley and Isaiah, are being baptised and we are so looking forward to that!

ReplyDeleteGreat job Kim!! I also pay myself first.

ReplyDelete